I've been reading a biography of William Wilberforce, and I've been amazed at how he progressed from a spoiled, partying rich kid to a sickly man with true purpose. His quote says it all, "God Almighty has set before me two great objects: the suppression of the slave trade and the reformation of manners." (By "manners" he meant "morals.")

I've been reading a biography of William Wilberforce, and I've been amazed at how he progressed from a spoiled, partying rich kid to a sickly man with true purpose. His quote says it all, "God Almighty has set before me two great objects: the suppression of the slave trade and the reformation of manners." (By "manners" he meant "morals.") During his 20 year fight to end the slave trade, he was frustrated on many levels and met defeat after defeat after defeat in votes in Britain's House of Commons. God gave him a purpose, and the resolve to achieve it, but did not make it easy--ending a great evil is never easy. Along the way, Wilberforce gathered many friends, and left many behind, choosing as his companions people of like mind and like morals. Rather than take anyone who would help, he chose those who really believed in what he was doing, who would continue the fight if his health failed, for whom eliminating the slave trade was more important than any of the participants. He left behind those who would support only because it was fashionable or popular.

In the same way, when seeking significant investors for a startup, the investor should be chosen because they have a real belief in the purpose of the company--advancing a new material, new software, new device--and this real belief is evidenced in their other investments and in the skills of their team. Investors who really believe in your company's purpose will not saddle the company with onerous terms that will otherwise make it difficult for the company to survive, to succeed, and to thrive.

Here are some terms that will not be requested by investors who have as their purpose the success of the company. Anyone who insists on them should be left behind. (Sometimes the true test of a leader is not what they do, but what they choose not to do.)

Participating Preferred Stock

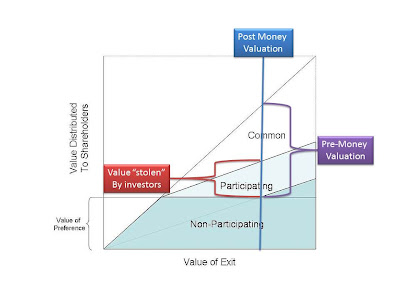

Participating preferred stock is stock that returns the initial capital and then also converts to common, allowing the investors to participate in the common portion of the exit. The problem is that immediately after closing, the value of the stock has appreciated to more than the value of the cash input into the company. For instance, if $5 million is used to buy 33% of the company, the value of the participating preferred stock post closing is not $5 million, but rather $8.3 million. The investors have "stolen" $3.3 million of the value that was created before their purchase. Anything that does not share the value of the company fairly is a show-stopper.

Right of First Refusal

Often requested by strategic investors, a right of first refusal (ROFR) allows them to take any purchase terms offered to the company by a third party. They will argue that the reason for their investment is so they can purchase the company later--and this is not to be discouraged. However, you want to make sure a market price is paid, and the only way is to have competition. The practical side is that, with a ROFR in place, most potential purchasers will not go to the trouble of due diligence to make an offer that could be taken from them at the last minute, and so the ROFR serves to submarine the final exit price. There are other, better ways to negotiate an exit or a purchase by a partner, including a call option with a 3rd party determined or negotiated price, and a short, pre-determined window of opportunity. Anything that would serve to minimize the exit value is a show-stopper.

Full Ratchet Anti-Dilution Rights

Full ratchet anti dilution rights allow the investor to re-price their investment in any subsequent down-round. The primary problem with full ratchet anti dilution is it allows the possibility that in the future the founders stock is worth nothing, if the down-round is severe enough. This "protection" actually gives the investors an incentive to encourage down-rounds in the future (which would increase their number of shares of ownership), and so serves to put the investors and the management at cross purposes--the investors want to submarine the future value of the company (pre-exit), while the management wants to increase the value in future rounds. Anything that causes the investors to want to submarine the value is a show-stopper.

Put Option

A put option is the right for an investor to "put" the shares back to the company at a set price in the future. Generally they are also limited in time, and generally the price is the same as or lower than the price paid for the stock. The problem is that the only time they would be put back to the company is if the company is perceived to be worth less than the option, which means it is likely going to have difficulty raising money and the Put Option will put the company into financial difficulty. The option can be used as a takeover mechanism for a company that may have great value based on its intellectual property, but not be in a strong cash position. (The put option would have the effect of creating debt, which is superior to all other equity, and could be used to force an involuntary bankruptcy in which the put option holder gains more, most, or even all of the equity in the company.) Anything that can be twisted into a takeover mechanism is a show-stopper.

Choosing a major investor is like choosing a spouse, a graduate school advisor, an employer, or a business partner. If done wisely, it can mean success to even a mediocre company. If done poorly, it can mean failure of the company, or at least financial failure to the founders. Among other things, the terms a company proposes can be used to understand their true motivation. This does not mean that you immediately reject any company that proposes these types of terms--it is common for a strategic to request a ROFR--but rather, after a measured discussion, if they will not give in or change the terms to something that allows a win-win, then walk away and search for an investor who has the long term goal to make the company a success for all of its owners.